Bookkeeping 101 For a Small Business

To cut right to the chase – don’t do it yourself. Hire someone. And yes, you should hire this person right away. This is a detail-oriented task that is so easy to screw up when you have thousands of other things going on.

And until you’re over $10,000,000 in revenue or so, it’s not a good idea to use a staff member to do it. They’ll judge how much people are getting paid and there are too many stories out there of how this gossip (“Did you hear how much Eddie makes?”) kills a company’s culture, and could force you to deal with labor and employment issues.

That being said, it is a good idea to be fully aware of and understand what’s in your Profit & Loss Statement (aka P&L) and what that means for your company and its growth potential. But first:

Revenue – Profit = Expenses, not Revenue – Expenses = Profit

Based on the standard P&L layout, we see revenue as the top-line, expenses as everything in the middle, and profit is the bottom line. And while that’s great for vernacular ( when focusing on top line growth, the bottom line is what is needed to make more money), it isn’t great for how to think about your business.

Unless you’re intentionally running a non-profit, you should follow the personal finance advice of paying yourself first and pay your business second. In other words: if you have $1,000,000 in revenue and you want a 15% profit margin, you have $850,000 to cover everything else. If you don’t take your profit first, expenses will appear that will eat up your margin. Some random problem will inevitably crop up and throwing money at it is the easiest solution…and there goes your profit.

The easiest way to do this – let’s assume that once your invoices are paid, the money goes into the company’s checking account. Take your profit margin (10%, 25%, whatever you determine it to be) and transfer that percentage of the payment into the company’s savings account.

This small action will shape the way your business looks at growth and profits and allow you a better framework for both.

Understanding Your Company’s P&L Statement

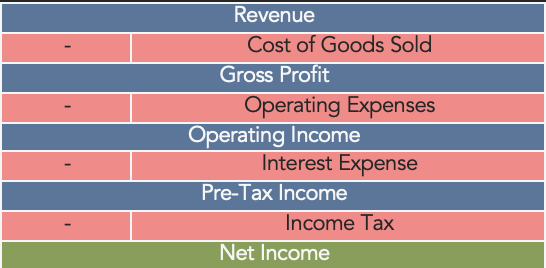

For a quick overview, most P&Ls follow this format:

Revenue is how much comes in from your customers.

Cost of goods sold is all the expenses to produce your product – raw materials, shipping costs, etc.

Once you subtract the cost of goods sold, you have your gross profit (also known as gross income).

Then subtract your operating expenses. Some businesses, depending on their complexity and industry, combine operating expenses and cost of goods sold. Other times these are segmented so it is easier to see where your money is going. Common operating expenses include sales, marketing, administrative costs, rent, utilities, payroll, etc.

This leaves you with your Operating Income – commonly referred to as EBIT (Earnings Before Interest and Taxes). This is a very important line on the P&L if/when you are looking to sell your business. Buyers look at this line very closely as a shorthand way to try and make apples-to-apples comparisons on companies across industries and regions. Whether they are right in doing so is a completely other discussion (short answer: sometimes).

After that, you have your financial charges – interest expenses, loan origination fees, etc. If your company finances sales to your customers, this number can be positive – i.e. you generate more interest than you spend.

After your financial expenses are subtracted, you have your pre-tax income, and after you subtract your tax bill, you are left with your net income, also known as profit.